Favorite Tips About How To Buy A Put Option

:max_bytes(150000):strip_icc()/dotdash_Final_Put_Option_Jun_2020-01-ed7e626ad06e42789151abc86206a1f3.jpg)

Ad trade with the options platform awarded for 7 consecutive years.

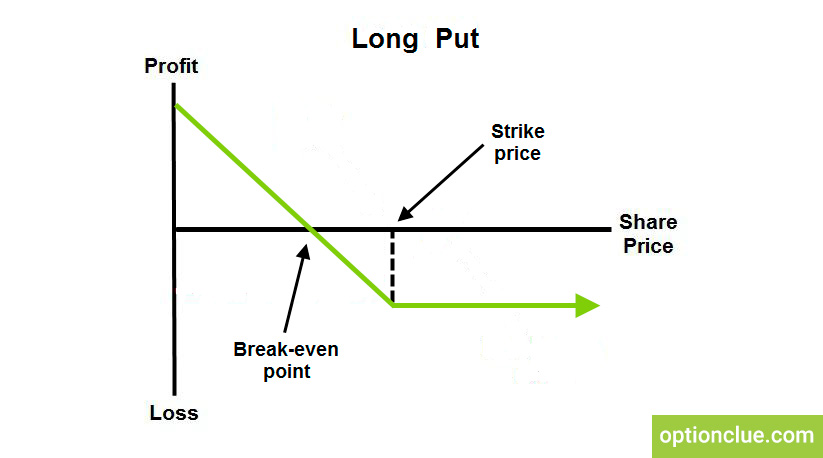

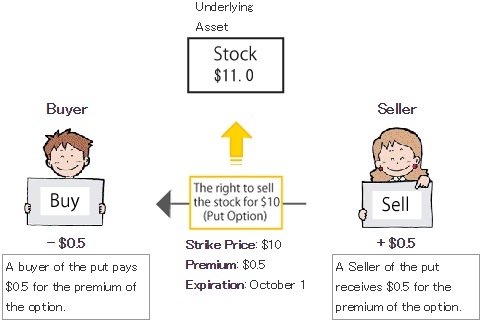

How to buy a put option. How to buy put options. One option is referred to as a contract, and it represents 100 shares of the underlying. The profit the buyer makes on the option depends on how far below the spot price falls.

If you’re a seller of a put, it. Ad trade with the options platform awarded for 7 consecutive years. In sum, as an alternative to buying 100 shares for $27,000, you can sell the put and lower your net cost to $220 a share (or a total of $22,000 for 100 shares, if the price falls to.

At that price, the stock can be bought in the market at $92 and sold through the exercise of the put at $95, for a profit of $3. For demo, we are looking at the apple stock (aapl). Less investment, higher profits put options.

You could purchase one put option and sell it for $1,290 at the end of the day. When you buy only the put option it completely changes the dynamics of the trade. A put option allows the buyer to lock in the selling price of the underlying asset for a fixed period.

Ad a superior option for options trading. Basically bearish and means you have a slight bearish position. As an options holder, you profit if the stock price.

This is a derivative that gives you a right to sell shares at a specified price. You want the stock price to fall. Your profit would be $10, but if you were to buy more options, you would multiply your gains (or.

:max_bytes(150000):strip_icc()/LongPut2-3d94ffb6f6964e578b68c7ec25bd1acd.png)

![How To Buy A Put Option - [Option Trading Basics] - Tradersfly](https://tradersfly.com/wp-content/uploads/2019/06/2017-07-27-buying-put-option-single-235.jpg)

![How To Buy A Put Option - [Option Trading Basics] - Youtube](https://i.ytimg.com/vi/z6lu992JvCk/maxresdefault.jpg)

/LongPut2-3d94ffb6f6964e578b68c7ec25bd1acd.png)

:max_bytes(150000):strip_icc()/BuyingPuts-4c4a647e895a41b8a828761e38465e1a.png)

![How To Buy A Put Option - [Option Trading Basics] - Tradersfly](https://tradersfly.com/wp-content/uploads/2019/06/2017-07-27-buying-put-option-single-081.jpg)

/LongPut2-3d94ffb6f6964e578b68c7ec25bd1acd.png)

:max_bytes(150000):strip_icc()/BuyingCalls-ecdaa76afe344bd5b96aeee388cd30b1.png)