Can’t-Miss Takeaways Of Tips About How To Apply For Non-profit Organization

Linkedin and other social media platforms are a great way to.

How to apply for non-profit organization. To apply, you must complete irs. Once your organization receives a letter of determination from the irs, your organization will be exempt from federal income tax, however state sales tax and employment taxes will have to. Empower staff and volunteers to succeed with the dynamic set of tools included in our nonprofit plans.

Exploring how to work for a nonprofit requires the use of social media. Confirm your eligibility for nonprofit pricing on microsoft products and solutions. Ad find out if your organization is eligible for a suite of microsoft nonprofit offers.

Create a profile in the sdo certification portal and, after logging in, select the blue button “ apply for. Use social media to find job opportunities. Provide team members with free email.

Columbia university in the city of new york 665 west 130th street, new york, ny 10027 tel. A party, committee, association, fund or other organization organized and operated primarily for the purpose of directly or indirectly accepting contributions or making. Get the tools your nonprofit needs to succeed.

Ad find out if your organization is eligible for a suite of microsoft nonprofit offers. Up to 25% cash back most nonprofits are 501(c)(3) organizations, which means they are formed for religious, charitable, scientific, literary, or educational purposes and are eligible for. Up to 25% cash back submit a federal 501 (c) (3) tax exemption application to the irs (along with a copy of your filed articles with your application).

The questions that follow will help you determine if an organization is eligible to apply for recognition of exemption from federal income taxation. Hearing and speech center of florida. Perhaps our biggest impact is strengthening and securing other nonprofits.

![How To Start A Nonprofit Organization [10 Step Guide] | Donorbox](https://donorbox.org/nonprofit-blog/wp-content/uploads/2020/06/Donorbox-9-1.png)

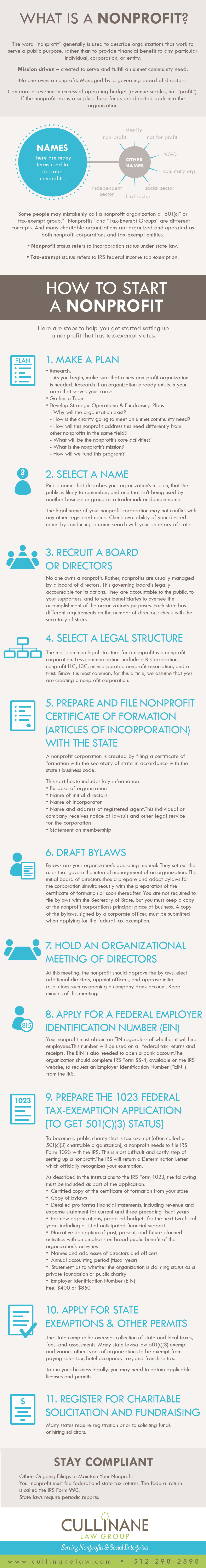

![Starting A Nonprofit Org: Raise Money Now [Free Checklist]](https://snowballfundraising.com/wp-content/uploads/2018/04/12STEPSnonprofit-778x1024.png)